Renewable energies for investors

Committed to the long-term goals of our investors.

Sustainability is an investment in the future – the best for our climate. And the best one for you. With our focus on renewable energies, we not only generate attractive returns but also help you to achieve your investment goals responsibly by making a sustainable positive contribution to the environment and resource conservation.

Best prospects for project planners

The project in focus, success in sight.

The CEE Group enjoys an excellent reputation among project developers in the solar and wind power business areas. As a long-standing and reliable investment partner with the highest financial strength, we are always on the lookout for projects, cooperation, and strategic collaboration for joint sustainable success.

Attractive opportunities for employees

Working where the future is in demand.

We are proud that dedicated people are at home in the CEE Group: We all stand together for a sustainable world with renewable energies, for sustainable perspectives and real values. In a strong and expanding economic sector – in which we act in a socially responsible and trustworthy manner with one another.

The CEE Group has acquired a photovoltaic project from project developer Chint Solar as part of a structured financing programme of DAL Deutsche Anlagen-Leasing (DAL). The solar park is being built in the municipality of Stüdenitz Schönermark (Ostprignitz-Ruppin district), 85 kilometres north-west of Berlin.

The CEE Group, a Hamburg-based asset manager specializing in renewable energies, has acquired a photovoltaic (PV) project in Brandenburg from project developer Chint Solar.

The CEE Group, a Hamburg-based asset manager specializing in renewable energies, has acquired a photovoltaic (PV) project in Brandenburg from project developer Chint Solar.

Sustainable successful projects.

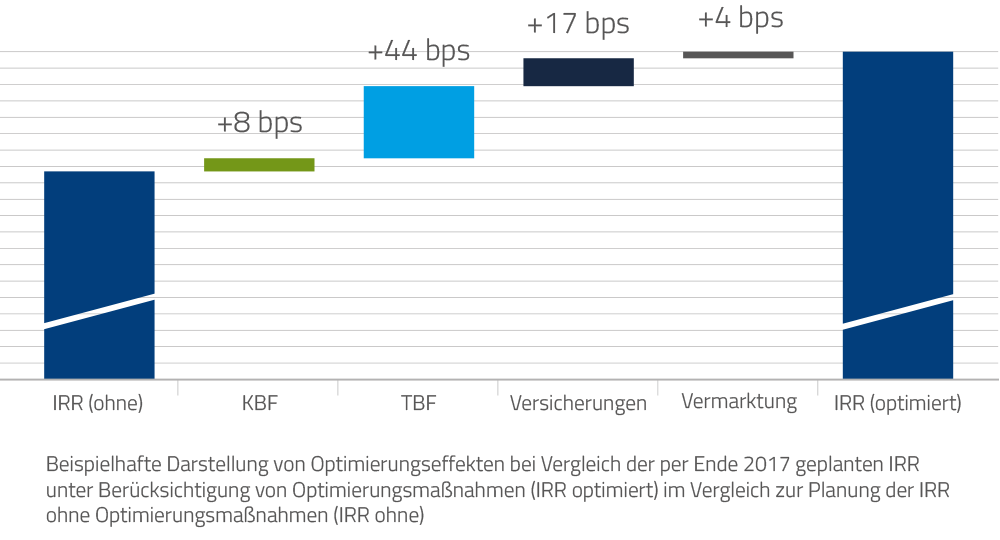

Over the last 20 years, we have acquired a large number of projects on a value basis and further optimised them through our highly professional management. This enabled us to regularly exceed our return targets. The following is an excerpt from our reference list.